Some regions in US to see 15% electricity demand growth through 2029; prices could escalate

LONDON and HOUSTON and SINGAPORE, Oct. 17, 2024 (GLOBE NEWSWIRE) — US power demand has remained essentially flat for the past decade, but this is all about to change as a pending surge in demand growth will be the biggest challenge for utility companies in decades, according to the latest Horizons report from Wood Mackenzie.

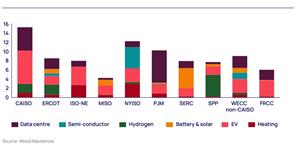

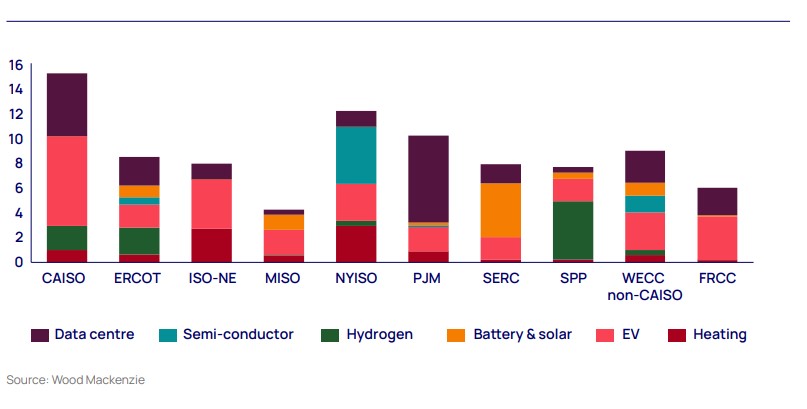

According to the report, “Gridlock: the demand dilemma facing the US power industry” US electricity demand growth will be between 4% and 15% through 2029, depending on the region, with burgeoning data-centre development, a resurgence in energy-intensive US manufacturing, and greater transport and heating electrification driving electricity demand growth not seen since the 1990s. Demand growth rates for individual utilities may be much higher as the demand being added to the grid is not evenly spread and one large load can have a significant impact on the growth of individual utilities.

All of this will prove a major challenge for utilities to adapt and provide interconnection and new supply, as well as companies with large electricity needs to sustain growth.

“In most industries, demand growth of 2-3% per year would be easily managed and welcomed,” said Chris Seiple, Vice Chairman of power and renewables with Wood Mackenzie. “In the power sector, however, new infrastructure planning takes 5 to 10 years, and the industry is only now starting to plan for growth.

“Moreover, most state public utility commissioners have little experience of regulating in a growth environment. And as technology C-suites realise that energy may be the largest constraint on their growth, they are shocked as businesses that move at light speed learn about the pace at which electric utilities move.”

Demand drivers

Data centers and the burgeoning artificial intelligence industry have become main drivers of activity, with Wood Mackenzie identifying 51 GW of new data-centre capacity announcements since January 2023. In the Horizons report, Wood Mackenzie has considered a scenario in which electricity demand from data centres grows by a mid-range estimate of 15% per year over the next five years, which is about 25 GW of new data centre capacity

Data centers will be competing with a resurgence in US manufacturing, particularly in the areas of battery, solar wafers and cells and semiconductors, which are projected to add up to15,000 MW of high-load-factor demand over the next few years

Lastly, the wider electrification of the economy will drive demand, with electric vehicle use continuing to grow and electrolysers connecting to the grid potentially adding another 7,000 MW of demand through 2030.

2024-29 GWh demand growth as a percentage of 2024 GWh demand

Many constraints are impacting the system’s ability to meet this demand growth, such as coal plant retirements, the lack of transformers and breakers needed to interconnect new plants and large loads, and the slow pace at which interconnection studies are completed and transmission capacity is added to the grid. From now to 2030, Wood Mackenzie forecasts annual utility-scale renewable additions to grow from around 29 GW to 40 GW per year.

“The constraint is not the demand for renewables, but the ability to get through permitting, interconnection and building out the transmission system accordingly,” said Seiple. “All things being equal, our renewable forecast additions would accommodate electricity demand growth of about 2% per year. If renewables are only able to barely match the pace of demand growth, it means we won’t be decarbonizing the power sector.”

A new paradigm, with upward pressure on price

Little demand growth the last 15 years in the US and some new supply from renewables has kept wholesale power prices lower, but this may change.

“With new demand growth comes a new era,” said Seiple. “Electricity prices will be under upward pressure. Valuations of fossil and nuclear assets are increasing as the market absorbs this new paradigm. More announcements of deferred coal plant retirements and efforts to reopen previously closed nuclear plants may follow. What will be most interesting is how this plays out in markets where there is no retail choice versus markets where it does exist.”

The report concludes that transmission planning, permitting and construction are the biggest bottlenecks to meeting future demand growth. It will take an integrated approach from utilities, regulators and policymakers to meet this challenge and buildout needed to protect US national security, boost strategic economic growth and decarbonise the power sector to address climate change.

“This will be a major challenge. The last time the US electricity industry saw unexpected new demand growth like this was during World War II,” said Seiple. “Between 1939 and 1944, manufacturing output tripled, and electricity demand rose 60%. It was a closely coordinated national effort that brought together industry and policymakers to address the challenge and find innovation along the way. A similar effort is needed now.”

Read the entire report here.

For further information please contact Wood Mackenzie’s media relations team:

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon

+65 8533 8860

hla.myatmon@woodmac.com

The Big Partnership (UK PR agency)

woodmac@bigpartnership.co.uk

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with ‘unsubscribe’ in the subject header.

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/12b17ac1-cdb5-4972-9b81-93f36e7ec4c9

GlobeNewswire Distribution ID 1000997640